End of the year planning guide

WANT TO OPTIMIZE YOUR END-OF-YEAR FINANCIAL STRATEGY?

Let our team of experts (our CFP® professionals, a CPA, and an Estate Planner) help you optimize your year-end financial strategy with our "End-of-Year Planning Guide".

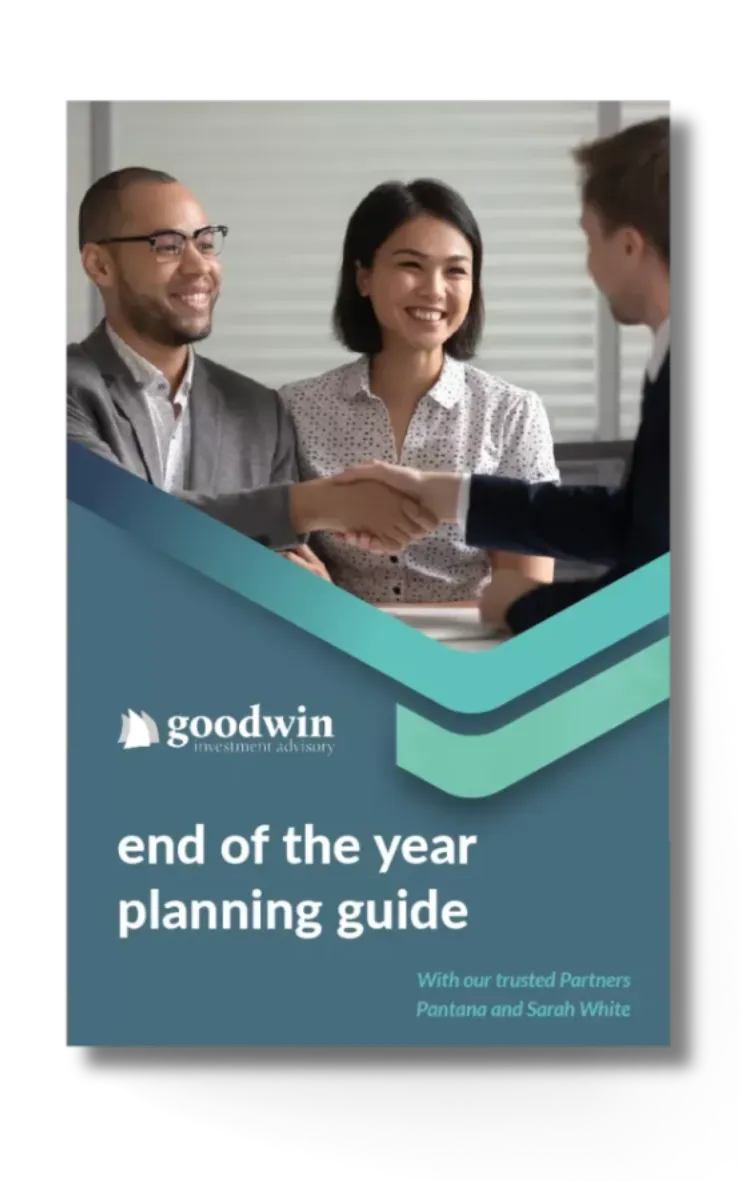

Allow me to introduce myself. I'm Tim and ...

I HAVE THE EXPERTISE TO STEER YOUR FINANCES TOWARDS OPTIMAL GROWTH.

As the year ends, financial planning is crucial, with many factors to consider and decisions to make. My 'End-of-Year Planning Guide' will simplify this process, providing essential up-to-date advice on tax planning, investment decisions, and estate considerations.

20+ years advising clients on financial planning

Expertise in tax planning, investment decisions, and estate considerations

Trusted advisor for individuals aiming for financial growth

The year-end dilemma

YOU DESERVE TO ENTER THE NEW YEAR WITH FINANCIAL CONFIDENCE.

I get it. Navigating the financial landscape as the year ends can be challenging. With so many variables and laws changing, it's easy to feel lost. What's stopping you from making the best financial decisions for the year-end?

Symptom #1

YOUR FINANCIAL PLANNING IS OVERWHELMING

The number of financial considerations to make as the year ends can be challenging. From tax planning and investment decisions to estate considerations, you're left feeling overwhelmed and unsure of the best steps to take.

Symptom #1

YOUR FINANCIAL PLANNING IS OVERWHELMING

The number of financial considerations to make as the year ends can be challenging. From tax planning and investment decisions to estate considerations, you're left feeling overwhelmed and unsure of the best steps to take.

Symptom #2

YOU'RE UNCERTAIN ABOUT TAX PLANNING

The tax laws are complex and ever-changing, leaving you uncertain about the best strategies to minimize your tax liabilities and optimize your financial growth.

Symptom #3

YOU'RE NOT CONFIDENT ABOUT YOUR YEAR-END FINANCIAL STRATEGY

Despite your efforts, you're not confident that your year-end financial strategy is optimized to ensure you enter the new year in a strong financial position.

Symptom #3

YOU'RE NOT CONFIDENT ABOUT YOUR YEAR-END FINANCIAL STRATEGY

Despite your efforts, you're not confident that your year-end financial strategy is optimized to ensure you enter the new year in a strong financial position.

GET CONTROL OF YOUR YEAR-END

FINANCES NOW

The Solution ...

OPTIMIZE YOUR YEAR-END FINANCIAL STRATEGY WITH CONFIDENCE!

You can continue feeling overwhelmed by the complexities of year-end financial planning ... OR ... you can equip yourself with my 'End-of-Year Planning Guide', a tool designed to simplify the process and provide clarity for your financial decisions. If you want expert guidance for your financial planning, start by downloading out guide.

- Tim Goodwin

Frequently Asked Questions

What services do you offer?

We provide financial planning, investment management, and business finance consulting.

Who are your ideal clients?

Individuals with $500,000 or more in retirement savings planning for retirement, early retirees, or those maximizing their legacy.

Can you work with clients outside of Atlanta?

Yes, we offer remote consultations across the United States using best-in-class technology.

Are your advisors certified?

Yes, all our advisors are Certified Financial Planners.

How do I get started with Goodwin Investment?

Schedule your intro call through our website.

What makes you different from other financial advisors?

We combine local expertise with advanced technology for remote consultations, supported by 5-star reviews and a BBB A+ score.

Shop: 238 River Park North Drive, Woodstock GA 30188

Call (678) 741-2370

Email: [email protected]

Site: https://go.goodwininvestment.com/